Starting a new nonprofit is no small feat—it takes vision, courage, and a deep commitment to making the world a better place. Whether you're addressing urgent community needs, creating space for voices that haven’t been heard, or building something brand new from the ground up, your decision to lead with purpose speaks volumes. At UNA, we believe in the power of nonprofits to shape strong, thriving communities.

1. Nonprofit Start-Ups: Essential Preparation

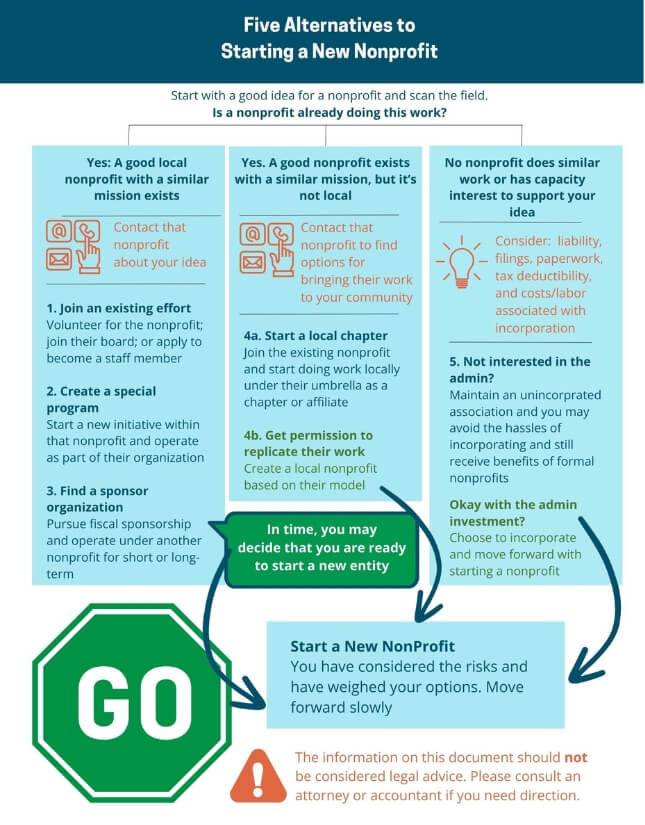

Starting a new nonprofit is an in-depth, legal process involving both state and federal government agencies. Understanding the level of interest for your mission, the availability of funding, and the ongoing reporting requirements before you begin the work required can help you determine if a new organization is needed—or if other, simpler alternatives might produce an even better outcome.

2. Know Your Options Before Launching a Start-Up

Nonprofits power what is good in our world, and it stands to reason that more nonprofits would make for an even better world! While that may typically be the case, it is not a universal truth.

Replicating the mission of existing nonprofits creates greater competition for funding, staff, volunteers, and more. It can act as a stressor on the community, rather than a salve.

As with for-profit businesses, start-up nonprofits have significant failure rates. The National Center on Charitable Statistics reports that about 30 percent of all nonprofits will close within 10 years of operations—and that figure does not include organizations that fail to thrive.

3. How UNA Helps

We are dedicated to strengthening Utah's nonprofit sector and want to make sure new nonprofits begin their work with a clear strategy for success.

Launching a new nonprofit can require legal and financial expertise—knowledge that falls outside of our organizational skill set. Should you need this type of technical assistance, please visit our Business Affiliate Members who are ready and able to help.

UNA's Guide to Starting a Nonprofit provides an overview of the process and offers some ideas for streamlining the work needed.

Our real expertise comes into play once you have your IRS Determination Letter and can join UNA as a nonprofit member. In the mean time, you may find value in becoming an Individual UNA member.